All Categories

Featured

Table of Contents

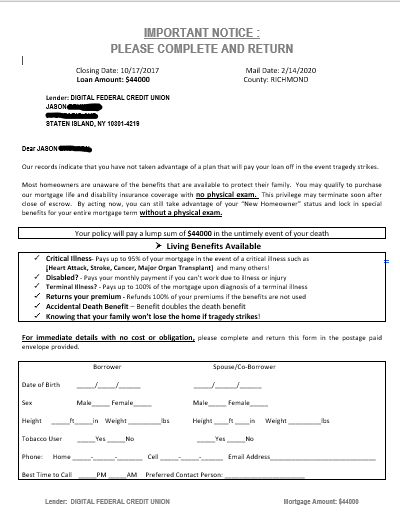

Home mortgage life insurance policy offers near-universal coverage with very little underwriting. There is often no clinical examination or blood sample required and can be a valuable insurance policy option for any homeowner with major pre-existing clinical problems which, would certainly prevent them from acquiring traditional life insurance policy. Various other benefits include: With a home mortgage life insurance policy plan in place, heirs will not need to worry or question what might happen to the household home.

With the mortgage paid off, the family will always belong to live, offered they can pay for the residential or commercial property taxes and insurance every year. does home insurance cover mortgage payments.

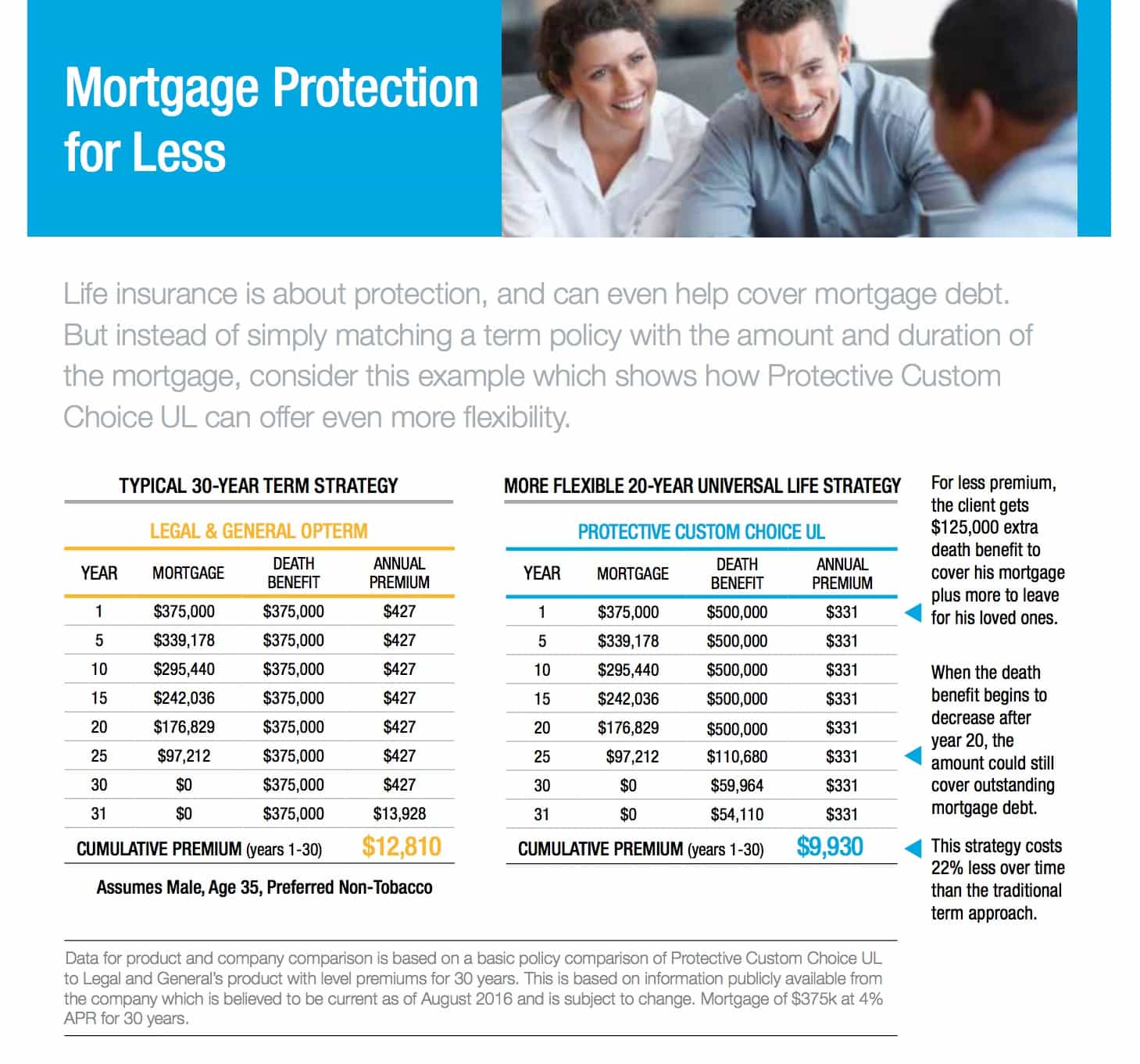

There are a couple of different kinds of home mortgage security insurance policy, these consist of:: as you pay more off your mortgage, the amount that the policy covers lowers in accordance with the superior balance of your mortgage. It is one of the most common and the most inexpensive kind of mortgage protection - mortgage risk insurance.: the quantity insured and the costs you pay remains level

This will certainly settle the mortgage and any continuing to be balance will certainly go to your estate.: if you want to, you can add severe ailment cover to your home loan defense policy. This means your home loan will certainly be gotten rid of not just if you die, yet additionally if you are identified with a major ailment that is covered by your policy.

How Much Is Payment Protection Insurance

Furthermore, if there is a balance continuing to be after the home mortgage is removed, this will go to your estate. If you alter your home mortgage, there are a number of points to take into consideration, depending on whether you are covering up or expanding your mortgage, changing, or paying the home loan off early. If you are topping up your mortgage, you require to make sure that your plan meets the brand-new value of your home loan.

Contrast the prices and advantages of both alternatives (best mortgage protection leads). It may be more affordable to maintain your initial home loan security policy and afterwards get a 2nd plan for the top-up amount. Whether you are topping up your mortgage or extending the term and need to get a new plan, you may discover that your premium is more than the last time you secured cover

Mortgage Protection Plan Vs Life Insurance

When switching your home loan, you can assign your home mortgage security to the brand-new lending institution. The premium and level of cover will coincide as prior to if the quantity you obtain, and the regard to your home mortgage does not alter. If you have a plan with your lending institution's group plan, your lending institution will terminate the policy when you switch your home loan.

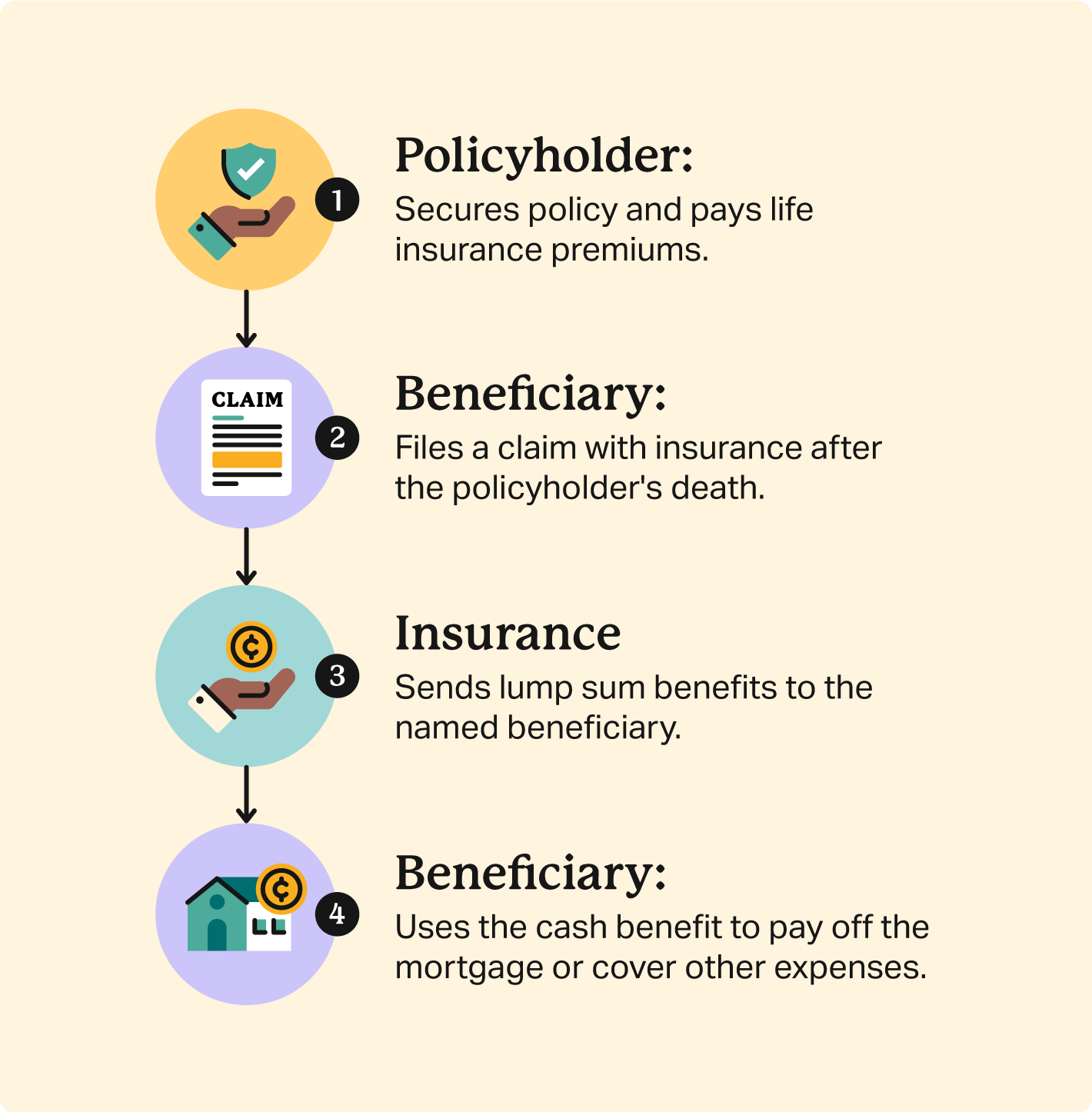

There will not be an emergency where a big costs schedules and no other way to pay it so not long after the fatality of an enjoyed one. You're offering comfort for your household! In California, home mortgage security insurance policy covers the entire outstanding balance of your lending. The death advantage is an amount equivalent to the balance of your home mortgage at the time of your death.

Mortgage Payment Insurance Calculator

It's important to recognize that the survivor benefit is offered straight to your creditor, not your enjoyed ones. This ensures that the staying debt is paid in complete which your loved ones are spared the economic pressure. Home mortgage security insurance policy can additionally provide short-lived protection if you become handicapped for an extensive duration (usually 6 months to a year).

There are several advantages to getting a mortgage protection insurance plan in California. Some of the leading advantages consist of: Assured approval: Also if you're in inadequate wellness or work in a harmful career, there is ensured approval with no clinical examinations or lab examinations. The same isn't true permanently insurance policy.

Disability security: As stated over, some MPI plans make a couple of home loan payments if you end up being impaired and can not bring in the same earnings you were accustomed to. It is essential to note that MPI, PMI, and MIP are all various types of insurance. Home mortgage security insurance coverage (MPI) is made to settle a home mortgage in situation of your fatality.

Buy Mortgage Protection Online

You can also use online in mins and have your plan in position within the same day. For more details about getting MPI insurance coverage for your home finance, get in touch with Pronto Insurance policy today! Our well-informed representatives are below to answer any type of concerns you may have and give more assistance.

MPI supplies numerous benefits, such as peace of mind and simplified certification processes. The death benefit is directly paid to the loan provider, which restricts versatility - online mortgage life insurance protection. Furthermore, the advantage quantity lowers over time, and MPI can be extra pricey than standard term life insurance policy policies.

Loan Protection Premium

Go into basic info concerning yourself and your home mortgage, and we'll contrast prices from various insurance firms. We'll additionally reveal you exactly how much protection you need to safeguard your home mortgage.

The main advantage here is clarity and confidence in your decision, understanding you have a plan that fits your demands. When you approve the strategy, we'll deal with all the documentation and setup, ensuring a smooth implementation procedure. The favorable outcome is the satisfaction that includes understanding your household is protected and your home is secure, no matter what happens.

Expert Suggestions: Advice from skilled experts in insurance and annuities. Hassle-Free Arrangement: We take care of all the documents and execution. Economical Solutions: Finding the most effective coverage at the most affordable feasible cost.: MPI particularly covers your home mortgage, giving an additional layer of protection.: We function to discover the most cost-efficient solutions tailored to your budget plan.

They can supply info on the coverage and advantages that you have. On standard, a healthy person can expect to pay around $50 to $100 per month for home mortgage life insurance policy. Nevertheless, it's advised to acquire a customized home mortgage life insurance policy quote to obtain a precise price quote based on private circumstances.

Latest Posts

Types Of Final Expense Insurance

Final Expense Insurance Pa

Final Expense Whole Life Insurance Reviews