All Categories

Featured

Table of Contents

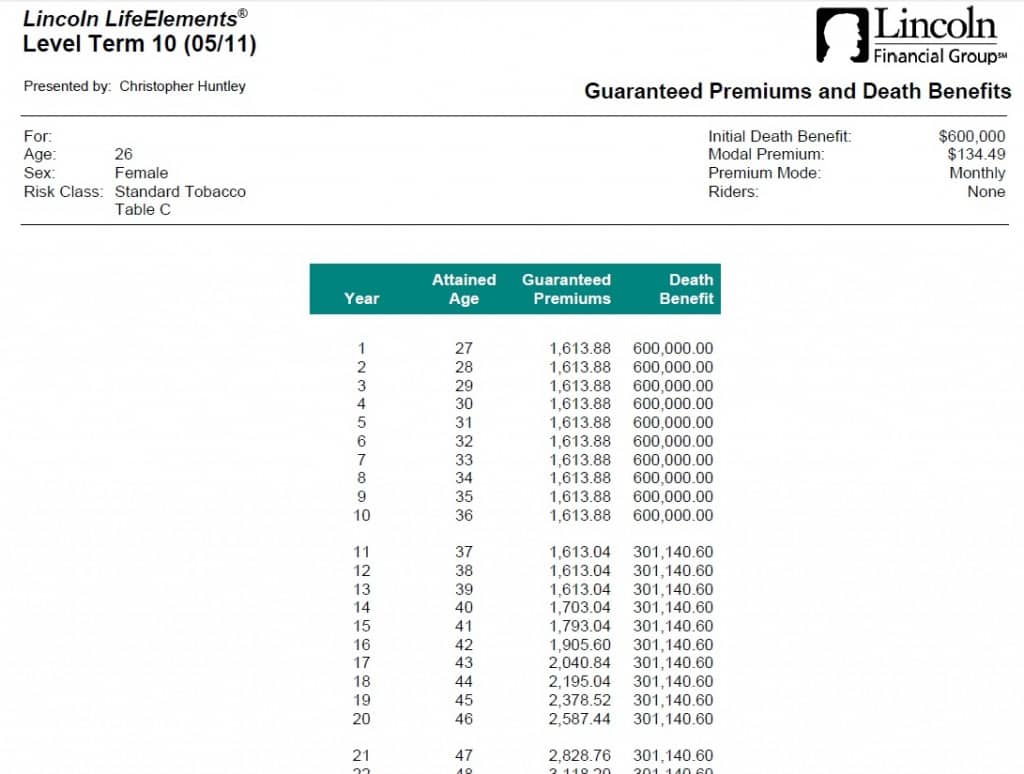

That generally makes them a more inexpensive choice for life insurance coverage. Some term plans may not maintain the premium and fatality benefit the exact same gradually. 30-year level term life insurance. You do not wish to incorrectly assume you're acquiring level term coverage and after that have your death advantage modification later on. Many individuals get life insurance policy coverage to aid monetarily protect their enjoyed ones in situation of their unforeseen death.

Or you might have the option to transform your existing term protection right into a long-term policy that lasts the remainder of your life. Different life insurance plans have potential benefits and disadvantages, so it's important to comprehend each before you make a decision to purchase a policy.

As long as you pay the premium, your recipients will certainly get the death advantage if you pass away while covered. That said, it is necessary to note that many plans are contestable for 2 years which implies protection could be retracted on fatality, should a misstatement be found in the application. Policies that are not contestable typically have actually a graded death benefit.

What is 10-year Level Term Life Insurance? Key Considerations?

Costs are generally lower than entire life plans. You're not locked into an agreement for the rest of your life.

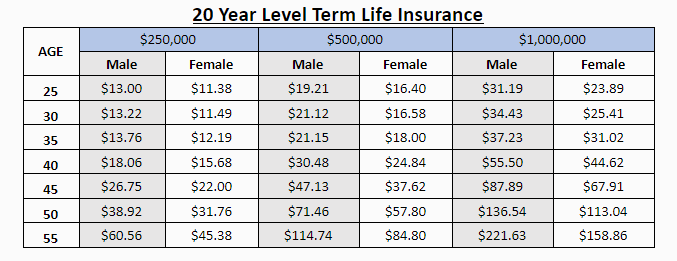

And you can't squander your plan during its term, so you won't obtain any economic advantage from your previous protection. Similar to various other sorts of life insurance policy, the cost of a degree term policy depends on your age, protection needs, work, way of living and health. Usually, you'll discover much more affordable protection if you're more youthful, healthier and less risky to guarantee.

Considering that level term costs remain the same for the period of protection, you'll recognize specifically just how much you'll pay each time. Degree term protection likewise has some adaptability, allowing you to tailor your plan with added attributes.

How Does 10-year Level Term Life Insurance Protect You?

You may have to meet specific problems and credentials for your insurer to pass this motorcyclist. In addition, there might be a waiting period of up to six months prior to working. There also can be an age or time frame on the insurance coverage. You can include a youngster rider to your life insurance policy plan so it likewise covers your children.

The fatality advantage is normally smaller sized, and insurance coverage typically lasts till your child transforms 18 or 25. This cyclist may be a more cost-efficient method to aid guarantee your children are covered as riders can typically cover numerous dependents simultaneously. When your kid ages out of this coverage, it may be possible to transform the cyclist into a brand-new policy.

The most usual kind of long-term life insurance is entire life insurance policy, but it has some crucial differences contrasted to degree term protection. Right here's a fundamental introduction of what to take into consideration when comparing term vs.

What is the Role of Level Term Life Insurance?

Whole life entire lasts for life, while term coverage lasts protection a specific periodDetails The premiums for term life insurance coverage are normally reduced than whole life insurance coverage.

One of the major attributes of degree term protection is that your premiums and your death benefit don't change. You may have insurance coverage that starts with a death advantage of $10,000, which might cover a home mortgage, and after that each year, the death advantage will certainly decrease by a set quantity or percent.

Due to this, it's frequently an extra budget friendly kind of degree term insurance coverage. You might have life insurance policy through your employer, but it might not suffice life insurance policy for your requirements. The very first step when acquiring a policy is establishing just how much life insurance policy you require. Think about aspects such as: Age Family members size and ages Work standing Earnings Debt Way of living Expected last expenditures A life insurance policy calculator can help figure out just how much you need to begin.

What is Voluntary Term Life Insurance? Understand the Details

After deciding on a plan, finish the application. If you're authorized, authorize the documents and pay your initial costs.

You may want to update your beneficiary info if you've had any considerable life modifications, such as a marriage, birth or divorce. Life insurance can occasionally really feel challenging.

No, level term life insurance coverage does not have cash value. Some life insurance policy plans have an investment attribute that enables you to build cash value over time. A part of your premium repayments is reserved and can make rate of interest in time, which grows tax-deferred during the life of your insurance coverage.

You have some alternatives if you still desire some life insurance policy protection. You can: If you're 65 and your insurance coverage has actually run out, for instance, you may desire to acquire a brand-new 10-year level term life insurance policy.

What is What Is Direct Term Life Insurance? Key Points to Consider?

You might be able to transform your term protection right into a whole life policy that will certainly last for the rest of your life. Lots of sorts of level term policies are exchangeable. That means, at the end of your protection, you can transform some or every one of your plan to entire life insurance coverage.

A degree premium term life insurance policy plan allows you adhere to your spending plan while you assist protect your family. Unlike some tipped price strategies that enhances yearly with your age, this kind of term strategy provides rates that stay the very same for the duration you choose, even as you grow older or your health changes.

Discover more concerning the Life insurance policy alternatives readily available to you as an AICPA participant (term life insurance for seniors). ___ Aon Insurance Coverage Solutions is the brand name for the brokerage and program management operations of Fondness Insurance Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Firm, Inc. (CA 0795465); in OK, AIS Affinity Insurance Coverage Services Inc.; in CA, Aon Affinity Insurance Solutions, Inc .

Latest Posts

Types Of Final Expense Insurance

Final Expense Insurance Pa

Final Expense Whole Life Insurance Reviews