All Categories

Featured

Table of Contents

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - whole life insurance with investment benefits agents specialize in. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

It enables you to spending plan and plan for the future. You can quickly factor your life insurance policy right into your budget due to the fact that the premiums never ever alter. You can prepare for the future equally as easily since you know exactly just how much money your enjoyed ones will certainly receive in the occasion of your absence.

This holds true for individuals that stopped smoking or that have a wellness problem that fixes. In these situations, you'll usually need to go via a brand-new application procedure to obtain a far better rate. If you still require protection by the time your degree term life plan nears the expiration day, you have a couple of options.

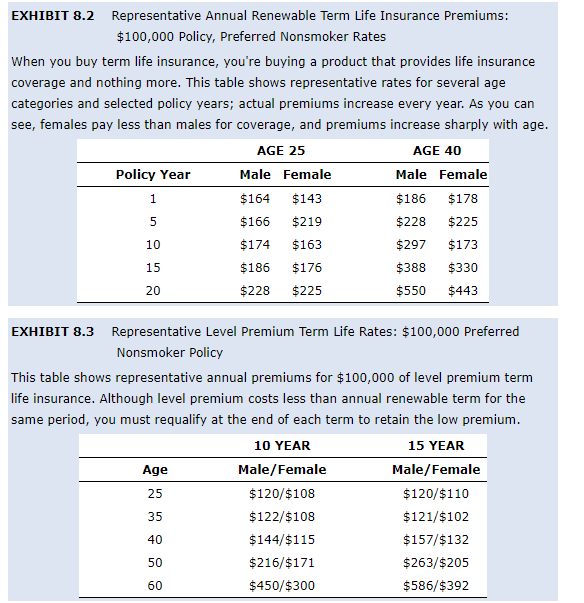

A lot of degree term life insurance policy plans include the alternative to restore insurance coverage on an annual basis after the preliminary term ends. what is level term life insurance. The price of your plan will certainly be based on your current age and it'll increase every year. This could be a good choice if you just require to expand your protection for a couple of years or else, it can get pricey rather rapidly

Level term life insurance policy is just one of the least expensive coverage alternatives on the market due to the fact that it offers standard protection in the form of survivor benefit and just lasts for a set amount of time. At the end of the term, it ends. Whole life insurance policy, on the other hand, is significantly more expensive than level term life due to the fact that it does not run out and features a cash value attribute.

Cost-Effective Term Life Insurance For Couples

Prices might differ by insurance company, term, insurance coverage quantity, health course, and state. Not all plans are offered in all states. Price illustration legitimate since 10/01/2024. Degree term is a terrific life insurance coverage choice for most individuals, however depending on your protection demands and personal circumstance, it may not be the best fit for you.

This can be a good choice if you, for instance, have simply quit smoking cigarettes and need to wait two or three years to use for a degree term policy and be qualified for a reduced rate.

Renowned Term Life Insurance For Couples

, your death benefit payment will reduce over time, but your repayments will certainly remain the exact same. On the other hand, you'll pay more ahead of time for less coverage with a boosting term life plan than with a degree term life plan. If you're not certain which type of plan is best for you, working with an independent broker can assist.

When you've determined that degree term is ideal for you, the next action is to acquire your plan. Below's just how to do it. Determine how much life insurance policy you require Your protection quantity must offer your household's lasting economic needs, including the loss of your income in case of your death, along with financial debts and day-to-day expenses.

A level premium term life insurance plan allows you stick to your budget plan while you aid protect your family. ___ Aon Insurance Coverage Providers is the brand name for the broker agent and program management operations of Affinity Insurance Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Policy Agency, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Coverage Providers Inc.; in CA, Aon Affinity Insurance Coverage Providers, Inc.

The Strategy Representative of the AICPA Insurance Trust Fund, Aon Insurance Coverage Providers, is not associated with Prudential.

Latest Posts

Types Of Final Expense Insurance

Final Expense Insurance Pa

Final Expense Whole Life Insurance Reviews